The Sticker Shock Nobody Warns You About

Walk into any senior living community, ask for the monthly rate, and watch even the most composed family member blink hard. According to Genworth’s 2024 Cost of Care Survey, the median cost for assisted living in the U.S. has hit $5,350 a month (roughly $70,000 a year)1. And that does not include medications, personal care, or memory care support.

So, when your parent, spouse, or grandparent needs long-term care, the question quickly becomes: Who’s actually paying for this?

In senior living, two payment paths dominate: Private Pay (you or your family pay directly) and Medicaid (government-funded care for those with limited income and assets).

These two systems live in the same universe but play by completely different rules. And the way payments move, from billing software to bank account, can mean the difference between a smooth experience and months of financial stress.

Let’s strip out the jargon and talk about how each one really works, why the differences matter, and how modern healthcare payment technology is helping to simplify the chaos.

- Private Pay: Financial Freedom with a Side of Financial Pressure

- Medicaid: Financial Relief with Built-In Bureaucracy

- Private Pay Vs. Medicaid: Comparison

- Decision Checklist for Families

- Frequently Asked Questions

- What does “Private Pay” actually cover?

- Can Medicaid cover assisted living or just nursing homes?

- Can someone start on Private Pay and later switch to Medicaid?

- Why do some facilities not take Medicaid?

- How long does Medicaid approval take?

- How can online billing help me?

- Is Private Pay safer than Medicaid?

- What if a facility raises rates and we can’t afford them?

- Do these payment methods affect care quality?

- What security standards protect my data when paying electronically?

- Is there a best time to apply for Medicaid?

- Conclusion: Clarity, Compassion, and the Power of Good Systems

Private Pay: Financial Freedom with a Side of Financial Pressure

When families hear “Private Pay,” they often imagine control, choice, and flexibility. That’s true, to a point. Private Pay simply means you pay for care out of personal funds. It can come from savings, retirement accounts, Social Security income, pension checks, family contributions, or a long-term care insurance policy. There’s no eligibility paperwork, no state application process, no government reimbursement timeline. You move in, the community bills you directly, and you pay. Simple enough.

Except, it’s not always simple.

The Reality of Private Pay Costs

Most of those moving into senior living begin by paying out of pocket. In fact, industry data shows that about 80% of assisted living residents use personal savings, retirement income, or family support to cover monthly fees. At first, that might seem manageable. But over time, even healthy savings accounts can start to shrink. It’s one of the biggest emotional and financial challenges families face, balancing the comfort of quality care with the long-term reality of how fast those dollars go.

That’s why it helps to understand exactly what you’re paying for and how your community structures its billing. Most senior living providers now offer clearer, more predictable monthly statements and convenient ways to pay, so you can track expenses and avoid surprises. Whether you prefer online payments or traditional mail-in options, the key is transparency: Knowing when payments are due, what services were provided, and how costs may change over time.

Clear communication about billing can make a stressful situation just a little less overwhelming. And when families can see exactly where their money goes, it becomes easier to focus on what really matters: ensuring loved ones receive the best possible care.

Why Facilities Love Private Pay

From the facility’s point of view, Private Pay is a dream. Payments arrive directly. The billing team can use healthcare payment software to reconcile transactions in minutes instead of days. Revenue is predictable. There’s no state paperwork to file, no delayed reimbursements, and no compliance audits from Medicaid agencies. Facilities often use HIPAA-compliant, PCI-certified payment systems to safeguard payment data. Platforms like TransactCare (which integrates with an Electronic Health Record platform, like PointClickCare, but functions independently) let administrators send invoices automatically and residents pay online with credit cards or their bank accounts through secure portals. In short: Private Pay offers simplicity and speed for both you and the facility.

When Private Pay Stops Being Sustainable

The hard truth: Families may eventually outlive their savings. At that point, families often transition from Private Pay to Medicaid. This process requires careful timing, documentation, and sometimes, a waiting list. Planning ahead with financial advisors who understand health payment systems and senior care can help you bridge the transition before savings run dry.

Medicaid: Financial Relief with Built-In Bureaucracy

If Private Pay is the “freedom to pay,” Medicaid is the “safety net when you can’t.” It’s a joint federal and state program that helps individuals with limited income and assets afford long-term care. On paper, it’s designed to make sure nobody goes without essential care. In practice, it’s a complex web of rules, eligibility tests, and billing regulations that can frustrate even experienced administrators.

Eligibility for Medicaid varies by state, but typically, you must:

- Have income and assets below state-defined thresholds (often around $2,000 in personal assets).

- Require assistance with daily living or medical care at a qualifying level.

- Be a U.S. citizen or legal resident.

If you own a home or have certain financial assets, you may need to “spend down” those resources before qualifying. Medicaid’s goal is to ensure funds are used for care before the state contributes.

Income/Asset Requirements to Qualify for Long-Term Care Medicaid by State:

| State | Type of Medicaid | Single | Married (both spouses applying) | Married (one spouse applying) |

| Alabama | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Alabama | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Alabama | Regular Medicaid / Medicaid for Elderly and Disabled | $1,014 / month | $1,511 / month | $1,511 / month |

| Alaska | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Alaska | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Alaska | Regular Medicaid / Aged Blind and Disabled | $1,795 / month (eff. 1/25 – 12/25) | $2,658 / month (eff. 1/25 – 12/25) | $2,658 / month (eff. 1/25 – 12/25) |

| Arizona | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Arizona | Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Arizona | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 2/25 – 1/26) | $1,763 / month (eff. 2/25 – 1/26) | $1,763 / month (eff. 2/25 – 1/26) |

| Arkansas | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Arkansas | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Arkansas | Regular Medicaid / Aged Blind and Disabled | $1,043.33 / month (eff. 4/25 – 3/26) | $1,410 / month (eff. 4/25 – 3/26) | $1,410 / month (eff. 4/25 – 3/26) |

| California | Institutional / Nursing Home Medicaid | No income limit, but resident is only permitted to keep $35 / month. | No income limit, but resident is only permitted to keep $35 / month. | No income limit, but resident is only permitted to keep $35 / month. |

| California | Medicaid Waivers / Home and Community Based Services | $1,801 / month (eff. 4/25 – 3/26) | $2,433 / month (eff. 4/25 – 3/26) | $2,433 / month for applicant (eff. 4/25 – 3/26) |

| California | Regular Medicaid / Aged Blind and Disabled | $1,801 / month (eff. 4/25 – 3/26) | $2,433 / month (eff. 4/25 – 3/26) | $2,401 / month (eff. 4/25 – 3/26) |

| Colorado | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Colorado | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Colorado | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Connecticut | Institutional / Nursing Home Medicaid | Income must be less than the cost of nursing home | Income must be less than the cost of nursing home | Income must be less than the cost of nursing home |

| Connecticut | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Connecticut | Regular Medicaid / Aged Blind and Disabled | $1,370 / month (eff. 3/25 – 4/26) | $2,198 / month (eff. 3/25 – 4/26) | $1,663 / month (eff. 3/25 – 4/26) |

| Delaware | Institutional / Nursing Home Medicaid | $2,485 / month | $4,970 / month ($2,485 / month per spouse) | $2,485 / month for the applicant |

| Delaware | Home and Community Based Services / Long Term Care Community Services | $2,485 / month | $4,970 / month ($2,485 / month per spouse) | $2,485 / month for the applicant |

| Delaware | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Florida | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Florida | Home and

Community Based Services |

$2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Florida | Regular Medicaid / Medicaid for Aged and Disabled | $1,149 / month (eff. 4/25 – 3/26) | $1,522 / month (eff. 4/25 – 3/26) | $1,522 / month (eff. 4/25 – 3/26) |

| Georgia | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Georgia | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Georgia | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Hawaii | Institutional / Nursing Home Medicaid | No hard income limit. One’s entire income except for $50 / month must go towards cost of care. | No hard income limit. Each spouse’s entire income except for $50 / month must go towards cost of care. | No hard income limit. Applicant’s entire income except for $50 / month must go towards cost of care. |

| Hawaii | Home and Community Based Services | If one lives at home $1,500 / month (eff. 2/25 – 1/26) | Each spouse is considered separately. If they are living at home, each spouse can have up to $1,500 / month. (eff. 2/25 – 1/26) | If one lives at home, applicant income limit of $1,500 / month (eff. 2/25 – 1/26) |

| Hawaii | Regular Medicaid / Aged Blind and Disabled | $1,500/ month (eff. 2/25 – 1/26) | $2,027 / month (eff. 2/25 – 1/26) | $2,027/ month (eff. 2/25 – 1/26) |

| Idaho | Institutional / Nursing Home Medicaid | $3,002 / month | $5,984 / month | $3,002 / month for applicant |

| Idaho | Medicaid Waivers / Home and Community Based Services | $3,002 / month | $5,984 / month | $3,002 / month for applicant |

| Idaho | Regular Medicaid / Aged Blind and Disabled | $1,047 / month | $1,511 / month | $1,511 / month |

| Illinois | Institutional / Nursing Home Medicaid | $1,304 / month (eff. 4/25 – 3/26) | $1,762 / month (eff. 4/25 – 3/26) | $1,304 / month for applicant (eff. 4/25 – 3/26) |

| Illinois | Medicaid Waivers / Home and Community Based Services | $1,304 / month (eff. 4/25 – 3/26) | $1,762 / month (eff. 4/25 – 3/26) | $1,304 / month for applicant (eff. 4/25 – 3/26) |

| Illinois | Regular Medicaid / Aid to Aged Blind and Disabled | $1,304 / month (eff. 4/25 – 3/26) | $1,762/ month (eff. 4/25 – 3/26) | $1,762 / month (eff. 4/25 – 3/26) |

| Indiana | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Indiana | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Indiana | Traditional Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 3/25 – 2/26) | $1,763 / month (eff. 3/25 – 2/26) | $1,763 / month (eff. 3/25 – 2/26) |

| Iowa | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Iowa | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Iowa | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Kansas | Institutional / Nursing Home Medicaid | No set income limit. Income over $62 / month must go towards one’s cost of care. | No set income limit. Income over $62 / month (per spouse) must go towards one’s cost of care. | No set income limit. Applicant’s income over $62 / month must go towards one’s cost of care. |

| Kansas | Medicaid Waivers / Home and Community Based Services | No set income limit. Income over $2,982 / month must be paid towards one’s cost of care. | No set income limit. Income over $2,982 / month (per spouse) must be paid towards one’s cost of care. | No set income limit. Applicant’s income over $2,982 / month must be paid towards one’s cost of care. |

| Kansas | Regular Medicaid / Aged Blind and Disabled | $967 / month (eff. 7/1/25) | $1,450 / month (eff. 7/1/25) | $1,450 / month (eff. 7/1/25) |

| Kentucky | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Kentucky | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Kentucky | Regular Medicaid / Aged Blind and Disabled | $235 / month | $291 / month | $291 / month |

| Louisiana | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Louisiana | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Louisiana | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Maine | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Maine | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Maine | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) |

| Maryland | Institutional / Nursing Home Medicaid | Cannot exceed the cost of nursing home care | Cannot exceed the cost of nursing home care | Applicant’s income cannot exceed the cost of nursing home care |

| Maryland | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Maryland | Regular Medicaid / Aged Blind and Disabled | $350 / month | $392 / month | $392 / month |

| Massachusetts | Institutional / Nursing Home Medicaid | No hard limit. Income over $72.80 / month must go towards care costs. | No hard limit. Income over $72.80 / month (per spouse) must go towards care costs. | No hard limit. Income over $72.80 / month must go towards care costs. |

| Massachusetts | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Massachusetts | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 3/25 – 2/26) | $1,763 / month (eff. 3/25 – 2/26) | $1,763 / month (eff. 3/25 – 2/26) |

| Michigan | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Michigan | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Michigan | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) |

| Minnesota | Institutional / Nursing Home Medicaid | $1,305 / month (eff. 7/25 – 6/26) | $1,764 / month (eff. 7/25 – 6/26) | $1,305 / month for applicant (eff. 7/25 – 6/26) |

| Minnesota | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Minnesota | Regular Medicaid / Elderly Blind and Disabled | $1,305 / month (eff. 7/25 –6/26) | $1,764 / month (eff. 7/25 –6/26) | $1,764 / month (eff. 7/25 –6/26) |

| Mississippi | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Mississippi | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Mississippi | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Missouri | Institutional / Nursing Home Medicaid | All available income except for $50 / month must be paid towards care | All available income except for $50 / month (per spouse) must be paid towards care | All applicant’s available income except for $50 / month must be paid towards care |

| Missouri | Medicaid Waivers / Home and Community Based Services | Structured Family Caregiving Waiver ($1,109 / month – eff. 4/25 – 3/26)

Aged & Disabled Waiver ($1,690 / month – eff. 1/25 – 12/25) |

Structured Family Caregiving Waiver ($1,109 / month per spouse – eff. 4/25 – 3/26)

Aged & Disabled Waiver ($1,690 / month per spouse – eff. 1/25 – 12/25) |

Structured Family Caregiving Waiver ($1,109 / month for applicant – eff. 4/25 – 3/26)

Aged & Disabled Waiver ($1,690 / month for applicant – eff. 1/25 – 12/25) |

| Missouri | Regular Medicaid / Aged Blind and Disabled | $1,109 / month for Aged & Disabled (eff 4/25 – 3/26). $1,305 / month for Blind (eff 4/25 – 3/26). | $1,499 / month for Aged & Disabled (eff 4/25 – 3/26). $1,763 / month for Blind (eff 4/25 – 3/26). | $1,499 / month for Aged & Disabled (eff 4/25 – 3/26). $1,763 / month for Blind (eff 4/25 – 3/26). |

| Montana | Institutional / Nursing Home Medicaid | Income must be equal or less than the cost of nursing home care | Income must be equal or less than the cost of nursing home care | Applicant’s income must be equal or less than the cost of nursing home care |

| Montana | Medicaid Waivers / Home and Community Based

Services |

$994 / month | $1,988 / month ($994 / month per spouse) | $994 / month for applicant |

| Montana | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Nebraska | Institutional / Nursing Home Medicaid | $1,305 / month (eff. 1/25 – 12/25) | $1,305 / month per spouse (eff. 1/25 – 12/25) | $1,305 / month for applicant (eff. 1/25 – 12/25) |

| Nebraska | Medicaid Waivers / Home and Community Based Services | $1,305 / month (eff. 1/25 – 12/25) | $1,305 / month per spouse (eff. 1/25 – 12/25) | $1,305 / month for applicant (eff. 1/25 – 12/25) |

| Nebraska | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) |

| Nevada | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Nevada | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Nevada | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| New Hampshire | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| New Hampshire | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| New Hampshire | Regular Medicaid / Old Age Assistance | $981 / month (eff. 1/25 – 12/25) | $1,451 / month (eff. 1/25 – 12/25) | $1,451 / month (eff. 1/25 – 12/25) |

| New Jersey | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| New Jersey | Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| New Jersey | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) |

| New Mexico | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| New Mexico | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| New Mexico | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| New York | Institutional / Nursing Home Medicaid | $1,800 / month (eff. 1/25 – 12/25) | $2,433 / month (eff. 1/25 – 12/25) | $1,800 / month for applicant (eff. 1/25 – 12/25) |

| New York | Medicaid Waivers / Home and Community Based Services | $1,800 / month (eff. 1/25 – 12/25) | $2,433 / month (eff. 1/25 – 12/25) | $1,800 / month for applicant (eff. 1/25 – 12/25) |

| New York | Regular Medicaid / Aged Blind and Disabled | $1,800 / month (eff. 1/25 – 12/25) | $2,433 / month (eff. 1/25 – 12/25) | $2,433 / month (eff. 1/25 – 12/25) |

| North Carolina | Institutional / Nursing Home Medicaid | Must be less than the amount Medicaid pays for nursing home care (est. $7,898.40 – $11,217.90 / mo.) | Must be less than the amount Medicaid pays for nursing home care (est. $7,898.40 – $11,217.90 / mo.) | Applicant’s income must be less than the amount Medicaid pays for nursing home care (est. $7,898.40 – $11,217.90 / mo.) |

| North Carolina | Medicaid Waivers / Home and Community Based Services | $1,305 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) | $1,305 / month for applicant (eff. 4/25 – 3/26) |

| North Carolina | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) |

| North Dakota | Institutional / Nursing Home Medicaid | No set limit. Applicant is allowed $100 for personal needs and the remaining income goes towards the cost of care. | No set limit. Couple is allowed $200 for personal needs. The remaining income goes towards the cost of care. | No set limit. Applicant is allowed $100 for personal needs and the remaining income goes towards the cost of care |

| North Dakota | Medicaid Waivers / Home and Community Based Services | $1,174 / month (eff. 4/25 – 3/26) | $1,587 / month (eff. 4/25 – 3/26) | $1,174 / month for applicant (eff. 4/25 – 3/26) |

| North Dakota | Regular Medicaid / Aged Blind and Disabled | $1,174 / month (eff. 4/25 – 3/26) | $1,587 / month (eff. 4/25 – 3/26) | $1,587 / month (eff. 4/25 – 3/26) |

| Ohio | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Ohio | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Ohio | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Oklahoma | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Oklahoma | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Oklahoma | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) | $1,763 / month (eff. 4/25 – 3/26) |

| Oregon | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Oregon | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Oregon | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Pennsylvania | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Pennsylvania | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Pennsylvania | Regular Medicaid / Aged Blind and Disabled | $989.10 / month (eff. 1/25 – 12/25) | $1,483.30 / month (eff. 1/25 – 12/25) | $1,483.30 / month (eff. 1/25 – 12/25) |

| Rhode Island | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Rhode Island | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Rhode Island | Regular Medicaid / Elders and Adults with Disabilities (EAD) | $1,304 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) |

| South Carolina | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| South Carolina | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| South Carolina | Regular Medicaid / Aged Blind or Disabled | $1,305 / month (eff 3/25 – 2/26) | $1,763 / month (eff 3/25 – 2/26) | $1,763 / month (eff 3/25 – 2/26) |

| South Dakota | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| South Dakota | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| South Dakota | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Tennessee | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Tennessee | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Tennessee | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Texas | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Texas | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Texas | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Utah | Institutional / Nursing Home Medicaid | No income limit. One’s monthly income determines how much one must pay towards the cost of care. | No income limit. Each spouse’s monthly income determines how much each spouse must pay towards the cost of care. | No income limit. Applicant’s monthly income determines how much one must pay towards the cost of care. |

| Utah | Medicaid Waivers / Home and Community Based Services | Aging Waiver ($1,305 / month – eff. 3/25 – 2/26)

New Choices Waiver ($2,982 / month – eff. 1/26 – 12/26) |

Aging Waiver (Each spouse is allowed up to $1,305 / month – eff. 3/25 – 2/26)

New Choices Waiver (Each spouse is allowed up to $2,982 / month – eff. 1/26 – 12/26) |

Aging Waiver ($1,305 / month for applicant – eff. 3/25 – 2/26)

New Choices Waiver ($2,982 / month for applicant month – eff. 1/26 – 12/26) |

| Utah | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 3/25 – 2/26) | $1,763 / month (eff. 3/25 – 2/26) | $1,763 / month (eff. 3/25 – 2/26) |

| Vermont | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Vermont | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Vermont | Regular Medicaid / Aged Blind and Disabled (outside Chittenden County) | $1,333 / month (eff. 1/25 – 12/25) | $1,333 / month (eff. 1/25 – 12/25) | $1,333 / month (eff. 1/25 – 12/25) |

| Vermont | Regular Medicaid / Aged Blind and Disabled (inside Chittenden County) | $1,441 / month (eff. 1/25 – 12/25) | $1,441 / month (eff. 1/25 – 12/25) | $1,441 / month (eff. 1/25 – 12/25) |

| Virginia | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Virginia | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Virginia | Regular Medicaid / Aged Blind and Disabled | $1,044 / month (eff. 1/25 – 12/25) | $1,410 / month (eff. 1/25 – 12/25) | $1,410 / month (eff. 1/25 – 12/25) |

| Washington | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Washington | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Washington | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Washington, DC | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Washington, DC | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Washington, DC | Regular Medicaid / Aged Blind and Disabled | $1,305 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) | $1,763 / month (eff. 1/25 – 12/25) |

| West Virginia | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| West Virginia | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| West Virginia | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

| Wisconsin | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Wisconsin | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Wisconsin | Regular Medicaid / Elderly Blind and Disabled (EBD) | $1,050.78 / month (eff. 1/25 – 12/25) | $1,582.05 / month (eff. 1/25 – 12/25) | $1,582.05 / month (eff. 1/25 – 12/25) |

| Wyoming | Institutional / Nursing Home Medicaid | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Wyoming | Medicaid Waivers / Home and Community Based Services | $2,982 / month | $5,964 / month ($2,982 / month per spouse) | $2,982 / month for applicant |

| Wyoming | Regular Medicaid / Aged Blind and Disabled | $994 / month | $1,491 / month | $1,491 / month |

Source: American Council on Aging (NOTE: Figures are accurate as of Oct. 2025. Figures may be outdated over time).

What Medicaid Actually Covers

Here’s where confusion begins. Medicaid often covers nursing home care fully but covers assisted living only in specific circumstances, typically through Home and Community-Based Services (HCBS) waivers. These waivers vary by state and can cap the number of participants or restrict certain services.

That means even if your loved one qualifies for Medicaid, the facility itself must also be authorized to accept Medicaid residents. Many communities limit the number of Medicaid beds or choose not to participate at all due to lower reimbursement rates.

The Billing and Payment Workflow

Medicaid billing is slow, complex, and full of compliance checkpoints. Each invoice must align with clinical documentation from the EHR, be verified through the facility’s billing system, and then submitted to the state or managed care organization for processing.

That’s where healthcare payment processing companies and enterprise payment platforms have become critical. Facilities that integrate billing through platforms like TransactCare can sync care records directly from systems like PointClickCare, ensuring that Medicaid claims match patient data as accurately as possible. This alignment reduces rejected claims, minimizes delays, and improves cash flow, all while maintaining HIPAA and PCI compliance.

The Trade-Off

Medicaid’s biggest advantage is financial relief. Its biggest disadvantage is limited choice. You may find fewer available communities, fewer amenities, and less flexibility in room type or care options. Still, for families who meet the criteria, it can be the best path to sustainable long-term care.

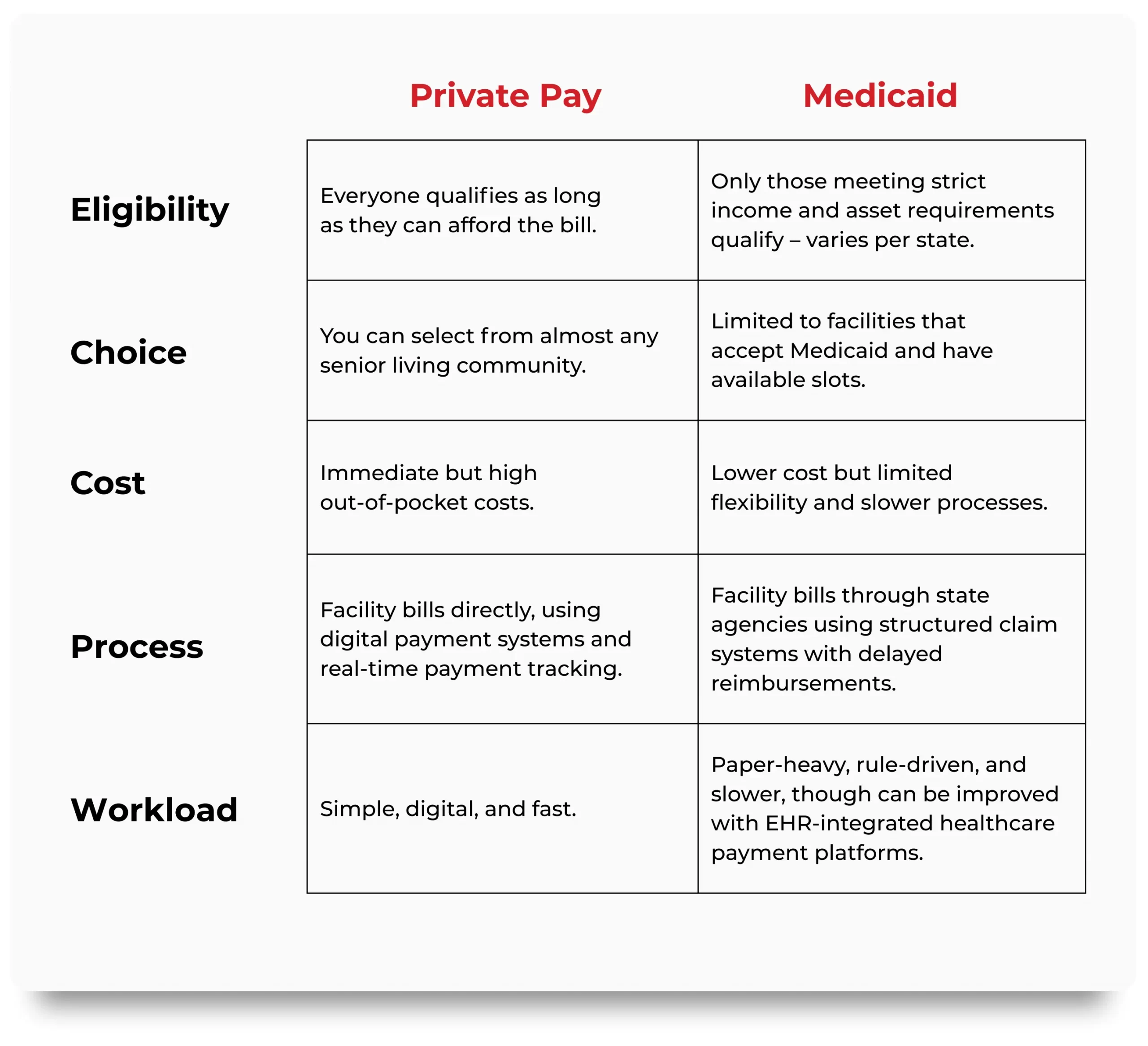

Private Pay Vs. Medicaid: Comparison

The choice often comes down to a family’s financial capacity and the facility’s payment technology. A community that invests in secure, automated healthcare payment solutions can make either path less painful.

Decision Checklist for Families

Before deciding which payment route fits your situation, use this checklist:

Frequently Asked Questions

What does “Private Pay” actually cover?

Private Pay means you or your loved one cover the full cost of senior living directly, rather than through a government program. Typically, this includes housing, meals, housekeeping, basic personal care, and community activities. Think of it as an all-inclusive monthly rate, though not always completely “all-inclusive.”

Many communities bill additional services separately. Transportation, medication management, physical therapy, and specialized medical care often come with extra fees. The range of what’s included varies widely by provider, so it’s important to review each community’s fee schedule carefully.

Families often appreciate that Private Pay offers more flexibility and choice. You can select your preferred room type, level of amenities, or specific care package without waiting for state approval or funding. Still, it’s important to plan ahead, as these costs can rise over time with inflation or changes in care needs.

Can Medicaid cover assisted living or just nursing homes?

Medicaid traditionally covers long-term care in nursing homes, where medical oversight is more intensive. However, in many states, Medicaid also supports assisted living through what’s called a Home and Community-Based Services (HCBS) waiver. These waivers allow people to receive care in less institutional environments, like assisted living, rather than moving into nursing homes.

Not every state offers the same coverage, and availability can be limited. Some states restrict how many people can enroll in these waivers each year, which often leads to waiting lists. The services covered may also differ from what you’d receive in a nursing facility. For instance, Medicaid might pay for personal care and meals but not private room upgrades or certain recreational activities.

It’s essential to talk with your state’s Medicaid office or an elder care financial advisor before assuming assisted living is covered. Knowing exactly what is funded, and what you may still need to pay privately, helps families budget realistically and avoid costly surprises later

Can someone start on Private Pay and later switch to Medicaid?

Yes, transitioning from Private Pay to Medicaid is common, especially when residents outlive their savings. This process is sometimes called a “spend-down.” Families pay privately until assets reach Medicaid’s eligibility threshold, then apply for state assistance to continue care.

That transition, however, is not always automatic. The community must accept Medicaid residents, and they may have a limited number of Medicaid-approved rooms. If your loved one’s community does not accept Medicaid, you might face a difficult decision about moving to another facility once funds run low. Starting the conversation early makes all the difference. Ask potential communities about Medicaid acceptance and transition policies before move-in. A bit of planning up front can spare your family the stress of relocation later, ensuring continuity of care and financial stability

Why do some facilities not take Medicaid?

Many senior living communities choose not to accept Medicaid residents because of financial and administrative constraints. Medicaid reimbursement rates are often lower than what facilities receive from Private Pay residents, which can make it difficult to cover operational costs. In addition, Medicaid billing comes with layers of compliance, documentation, and slower payment timelines. Facilities that are small or privately owned may not have the administrative infrastructure to handle this effectively. Some providers focus on Private Pay residents to maintain simpler, faster billing processes.

That doesn’t mean these facilities are inaccessible forever. Some communities participate in Medicaid selectively, holding a few reserved rooms for qualifying residents. It’s always worth asking each provider how they handle state-funded residents, sometimes flexibility exists, especially in larger organizations

How long does Medicaid approval take?

Medicaid approval timelines vary dramatically by state and by the completeness of your application. In straightforward cases, approval might take four to six weeks. In others, especially when verifying assets or waiting for documentation, the process can stretch several months. The application involves reviewing bank statements, property records, insurance policies, and income documentation. Any missing or unclear information can trigger delays. That’s why many families choose to work with an elder law attorney or financial professional experienced in Medicaid planning. While waiting, residents often continue paying privately, which can strain finances. Starting the paperwork early, ideally before funds are nearly depleted, ensures a smoother transition when eligibility begins.

How can online billing help me?

For most families, senior living costs are already emotionally and financially overwhelming. Digital payment options simplify one piece of that puzzle. Many communities now offer online portals where families can make payments, review invoices, and track account balances anytime. This level of transparency helps families manage budgets, confirm that services match billing, and avoid late fees. It also makes multi-family coordination easier. When adult children share financial responsibilities, everyone can see the same account details in real time. More importantly, digital systems create consistency. Knowing when payments are due and being able to pay securely from anywhere reduces stress and minimizes the chance of missed payments. Convenience can’t solve high costs, but it can make them easier to manage.

Is Private Pay safer than Medicaid?

Private Pay gives families more control and flexibility. You choose where your loved one lives, what services they receive, and when to make changes. There are fewer eligibility restrictions and fewer bureaucratic hurdles.

Medicaid, on the other hand, acts as a vital safety net when funds are gone. It guarantees essential care for those who qualify, even if personal resources run out. The trade-off is less choice and sometimes longer processing or reduced amenities.

The best approach is balance: plan for both. Families often start on Private Pay, then transition to Medicaid when needed. Financial advisors who specialize in senior care can help forecast this timeline so your loved one’s care continues seamlessly.

What if a facility raises rates and we can’t afford them?

Rate increases are common in senior living, staffing, food, and utilities all rise over time. When that happens, don’t panic or assume you have to move immediately. Start by talking to the community’s administrator or business office. They can explain the reason for the increase and may help identify ways to manage it. Some facilities offer tiered service packages or flexible care levels that can be adjusted to fit new budgets. Others may guide you through beginning a Medicaid application if eligibility is possible. Open communication is key; communities would rather help you plan than lose a long-time resident abruptly. If costs become unmanageable, work with a senior financial planner. There are sometimes tax advantages, veterans’ benefits, or other funding sources that can offset monthly expenses. The sooner you ask, the more options you’ll have.

Do these payment methods affect care quality?

Payment method does not necessarily dictate quality of care. What matters more is the facility’s culture, staffing, and leadership. A well-run community provides consistent, compassionate service to every resident, regardless of how the bill gets paid. That said, Private Pay residents may access certain premium amenities or private accommodations not covered by Medicaid. Those perks often reflect differences in funding, not in fundamental caregiving standards. Daily assistance, medication management, and safety protocols are typically consistent across the board. When evaluating care quality, focus on staff-to-resident ratios, resident satisfaction, and the facility’s inspection history rather than who pays the bill. Those metrics offer a truer picture of everyday care than the payment category ever could.

What security standards protect my data when paying electronically?

Electronic payments in senior living follow strict security standards designed to safeguard both financial and health information. The most important of these is PCI Level 1 compliance, which ensures credit card transactions are encrypted and processed through secure channels. In addition, facilities handling any resident health information must comply with HIPAA (the Health Insurance Portability and Accountability Act). This law governs how personal data is stored, transmitted, and accessed. Combining PCI and HIPAA standards creates a double layer of protection. Families can also do their part by using secure internet connections when making online payments and verifying that the community’s payment portal uses HTTPS encryption. Good systems make paying online safe, but a little extra caution never hurts.

Is there a best time to apply for Medicaid?

Yes. The best time is before your funds are nearly gone. Applying early gives you time to gather documents, correct errors, and respond to any state requests without risking a gap in care.Many people wait too long, starting the application only when savings are exhausted. Unfortunately, processing can take months, leaving families scrambling to cover bills in the meantime. Early preparation eliminates that risk. Start conversations with your facility’s financial coordinator or a Medicaid planning professional as soon as you anticipate needing support. A proactive approach ensures a smoother transition and peace of mind when financial resources tighten.

Conclusion: Clarity, Compassion, and the Power of Good Systems

Private Pay and Medicaid may seem like financial opposites, but they both serve one purpose: ensuring seniors receive care. The real difference lies in how the money moves. Private Pay is direct and flexible. Medicaid is regulated and protective. Both can work but only if the facility’s billing systems are modern, secure, and transparent. As facilities adopt automated healthcare payment solutions, enterprise payment systems, and EHR-integrated billing, residents and families finally get what they’ve wanted all along: visibility, control, and peace of mind.

Because aging is hard enough. Paying for it shouldn’t be.

- https://investor.genworth.com/news-events/press-releases/detail/982/genworth-and-carescout-release-cost-of-care-survey-results